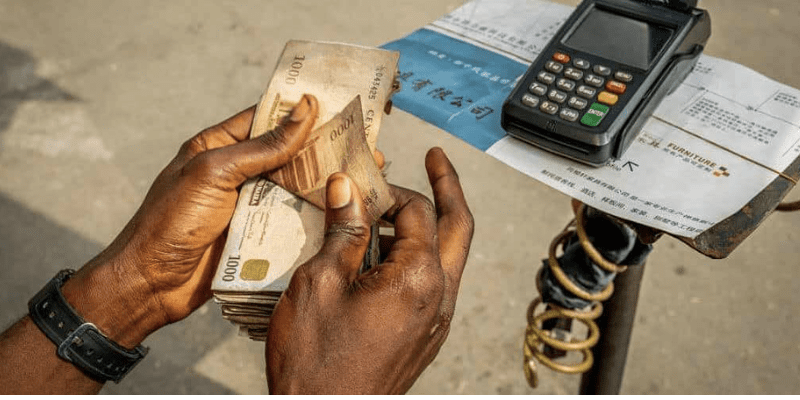

POS operators threaten to hike in transaction charges, states reasons

Some point-of-sale operators in Abuja have condemned the Corporate Affairs Commission’s directive that PoS agents register their businesses.

The CAC issued a two-month registration deadline on Monday for PoS operators to register their agents, merchants, and individuals with the commission in accordance with legal requirements and the directives of the Central Bank of Nigeria (CBN).

The agents, who spoke on Wednesday, said the registration, which would require money, would impact the transaction cost paid by customers.

Kofi Kolawole, a PoS agent, said the registration would deplete the business’s profits.

Mr Kolawole said the registration would also discourage people from entering the business.

“I know that this registration, when actualised by our operators, will increase the amount they charge us. This means that the cost we charge on each transaction will increase, so our customers will bear the cost,” he said.

Another PoS agent, Clement Agbasi, said the directive negated the CBN’s financial inclusion initiative.

Mr Agbasi said the directive would cause many customers to save their cash at home rather than being charged heavily for online transactions.

“The PoS business was geared toward bringing the banks closer to the unbanked and making it easier for them. With all these charges including the 0.5 per cent cyber-security levy on customers, many people will be discouraged from putting their money in banks,” he said.

Loretta Ubong, a PoS agent, said that although the registration was a welcome development, it must be done in a way that would not be detrimental to businesses.

Ms Ubong appealed to CAC to conduct the registration in line with best practices.

“I am a student, and I use the proceeds from this business to pay my bills. The commission should not do the registration in a way that will kill my business,” she said.

However, Ndidiamaka Ibe, a customer, said the registration would help to check financial frauds and sharp practices perpetrated with PoS.

“I was a victim of one-chance, and my over two million naira was withdrawn from a PoS. When I got to my bank, they could not trace the owner of the PoS. I think that what the federal government is trying to do is to check things like this so that when fraud is perpetrated by a PoS agent, he or she can be easily traced,” she said.

CAC said the registration aimed to safeguard the businesses of fintech’s customers and strengthen the economy. It gave July 7 as the deadline for the registration.

(NAN)